Swiss drugmaker Novartis on Friday won U.S. approval for its gene therapy Zolgensma for spinal muscular atrophy (SMA), the leading genetic cause of death in infants, and priced the one-time treatment at a record $2.125 million.

The Food and Drug Administration approved Zolgensma for children under the age of two with SMA, including those not yet showing symptoms. The approval covers babies with the deadliest form of the inherited disease as well as those with types where debilitating symptoms may set in later.

“This is potentially a new standard of care for babies with the most serious form of SMA,” said Dr. Emmanuelle Tiongson, a pediatric neurologist at Children’s Hospital Los Angeles who has provided Zolgensma to patients under an expanded access program. “The job now is trying to negotiate with insurers that this would be a long-term savings.”

Novartis executives defended the price, saying that a one-time treatment is more valuable than expensive long-term treatments that cost several hundred thousand dollars a year.

Novartis touched off a debate over what gene therapy is worth last year, estimating its treatment would be cost-effective at up to $5 million per patient. A review in April by an independent U.S. group, the Institute for Clinical and Economic Review (ICER), concluded Novartis’ value estimate for Zolgensma was excessive.

But on Friday, ICER said that based on Novartis’ additional clinical data, the broad FDA label and its launch price, it believed that the drug fell within the upper bound of its range for cost-effectiveness.

Novartis said it was offering health insurers the option of installment payments for Zolgensma as well as refunds if the treatment does not work and upfront discounts for payers who commit to standardized coverage terms.

Novartis Chief Executive Vas Narasimhan has much riding on Zolgensma, describing it as a near cure for SMA if delivered soon after birth. But data proving its durability extends to only about five years. The therapy uses a virus to provide a normal copy of the SMN1 gene to babies born with a defective gene. It is delivered by infusion.

A RIVAL TO BIOGEN

Novartis is expecting European and Japanese approval later this year. Zolgensma will compete with Biogen Inc’s Spinraza, the first approved treatment for SMA.

The disease often leads to paralysis, breathing difficulty and death within months for babies born with the most serious Type I form. SMA affects about one in every 10,000 live births, with 50 percent to 70 percent having Type I disease.

Spinraza, approved in late 2016, requires infusion into the spinal canal every four months. Its list price of $750,000 for the initial year and $375,000 annually thereafter was also deemed excessive by ICER.

Some neurologists see gene therapy becoming the preferred treatment for newborns with severe SMA, while acknowledging that families may choose to wait for long-term safety and efficacy data for Zolgensma. Novartis is looking into whether the death of one severely ill baby treated with Zolgensma was related to the therapy.

“Most families will want to do the gene therapy since it avoids the frequent spinal taps,” said Dr. Russell Butterfield of the University of Utah in Salt Lake City. Butterfield has received payments from Biogen for consulting.

The FDA said it approved Zolgensma based on clinical trials involving 36 patients aged 2 weeks to 8 months. The agency said patients treated with Zolgensma showed significant improvement in developmental motor milestones such as head control and ability to sit up.

The most common side effects of Zolgensma are elevated liver enzymes and vomiting. The FDA is requiring Zolgensma’s label to include a warning that acute serious liver injury can occur.

With additional studies underway, Novartis said it has so far treated more than 150 patients with Zolgensma, which was acquired with its $8.7 billion purchase of AveXis last year.

Wall Street analysts have forecast sales of $2 billion by 2022, according to a Refinitiv survey. Spinraza sales hit $1.7 billion last year, and are seen rising to $2.2 billion in 2022. Roche is developing risdiplam, an oral drug, for the condition and plans to file for approval later this year.

A PUSH FOR SCREENING

Novartis, Biogen and Roche, as well as patient advocates and neurologists, say babies with SMA who receive treatment before symptoms emerge stand the best chance of near-normal development. They are lobbying to make SMA screening standard for newborns in every market.

“Babies (with SMA) are losing motor neurons from the day they are born, so the ability to treat them as early as possible is the way you get maximum value out of the therapy,” David Lennon, who heads Novartis’ AveXis unit, said in a recent interview.

Dr. Laurent Servais, a child neurologist in Liege, Belgium, called any delay in implementing newborn SMA screening “completely unethical.”

Servais helped oversee a screening pilot program sponsored by the three companies. Southern Belgium is now screening 60,000 newborns annually, half the country’s total births. Taiwan has also begun testing babies for SMA.

But widespread adoption has a long way to go. In the United States, only six states have begun active and routine SMA newborn screening since the federal government recommended it in 2018. Patient advocates estimate it could take until 2022 for the testing to be implemented nationwide.

In Europe, it may be even slower.

England recommended against newborn screening in February and will not consider it again before 2021, a spokesman for Public Health England told Reuters. SMA advocates in Germany do not expect action on screening until late 2021.

“It’s astonishing,” said Inge Schwersenz, of the German Society for Neuromuscular Diseases. “But we can’t do anything to speed it up.”

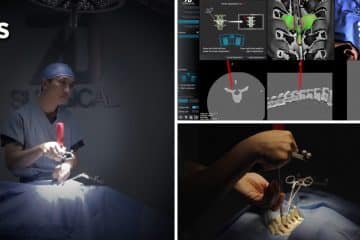

Read More: History of Surgery